“Everything is beautiful in its own way,” goes Ray Stevens’s hit song of 1970. But still, pay your bills.

That’s what I thought reading a Fox Business story on a recent poll in which 42 percent of Americans, a plurality, thought that “President Trump’s administration should forgive all federal student debt in order to help stimulate the economy.”

Roughly 37 percent disagree, at least. Twenty-one percent were undecided.

For starters, justifying a huge financial giveaway to some citizens at the expense of other citizens as a way to help “stimulate the economy”? A sad commentary on the state of civic discussion.

Of course, this particular voter survey may have been concocted as nothing more than some capitalist PR plot by MoneyTips.com. Still, the numbers are believable, and with total student debt reaching $1.3 trillion — owed by some 44 million Americans — the subject is certain to come up again.

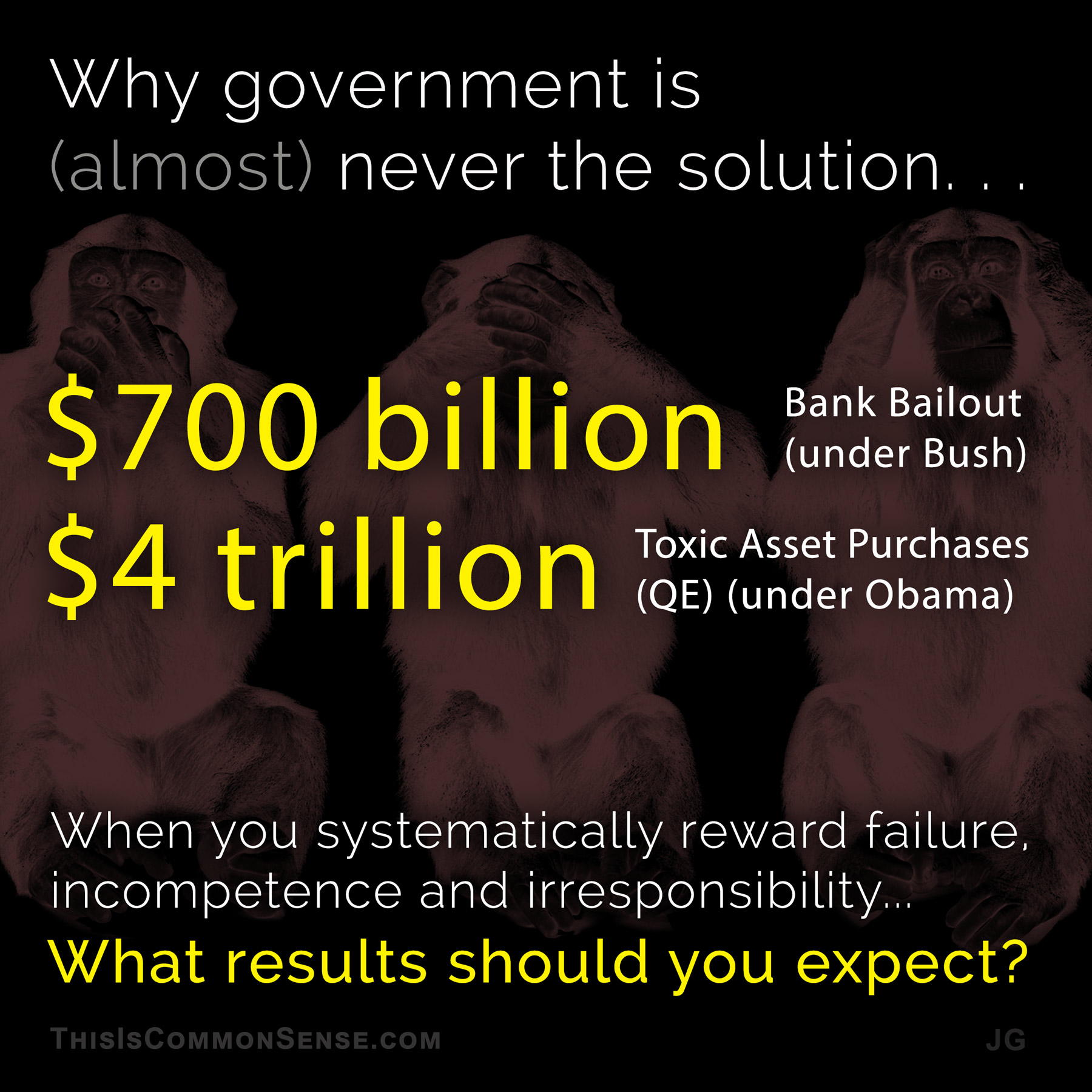

Let’s not forget, Bernie Sanders declared it a sin against public policy that Americans were not provided a free university-level education. I can hear his future oration, “We bailed out the banks for the one-percent. We can bail out the students!”

It should be a popular position on college campuses, cui bono and all.

“Drilling into the data, we found millennials (18-29) were especially passionate about student loan debt forgiveness, strongly agreeing with the idea nearly twice as much as those 50 and older,” confirmed MoneyTips co-founder Michael Dubrow. “Even if older people are still paying off their loans, younger people paid more and borrowed more for higher education.”

This sounds like a good reason to cut current subsidies, not increase them.

No. More. Bailouts.

This is Common Sense. I’m Paul Jacob.