Is it still capitalism if the capital is guaranteed?

“The U.S. government will guarantee all customer funds in Silicon Valley Bank (SVB) after a series of bad decisions and a run on deposits led to the bank’s collapse,” explains Elizabeth Nolan Brown in Reason.

Technically, the bank isn’t being bailed out. Its customers are. And that’s a lot more popular than bailing out banks directly. There are more bank customers who vote than bankers who vote — though there is probably more political donations from banks directly seeking banking policy “correctives” than bank customers doing the same. That’s almost apodictically true.

The most bizarre element? While the FDIC, the federal agency that insures depositors of this and similar banks, is designed to guarantee depositors’ capital up to a certain limited amount ($250,000, more or less), the regulatory triumvirate of Treasury Secretary Janet Yellen, Federal Reserve Board Chair Jerome Powell, and FDIC Chair Martin Gruenberg declare that “all depositors of this institution will be made whole.”

All.

Even the super-rich.

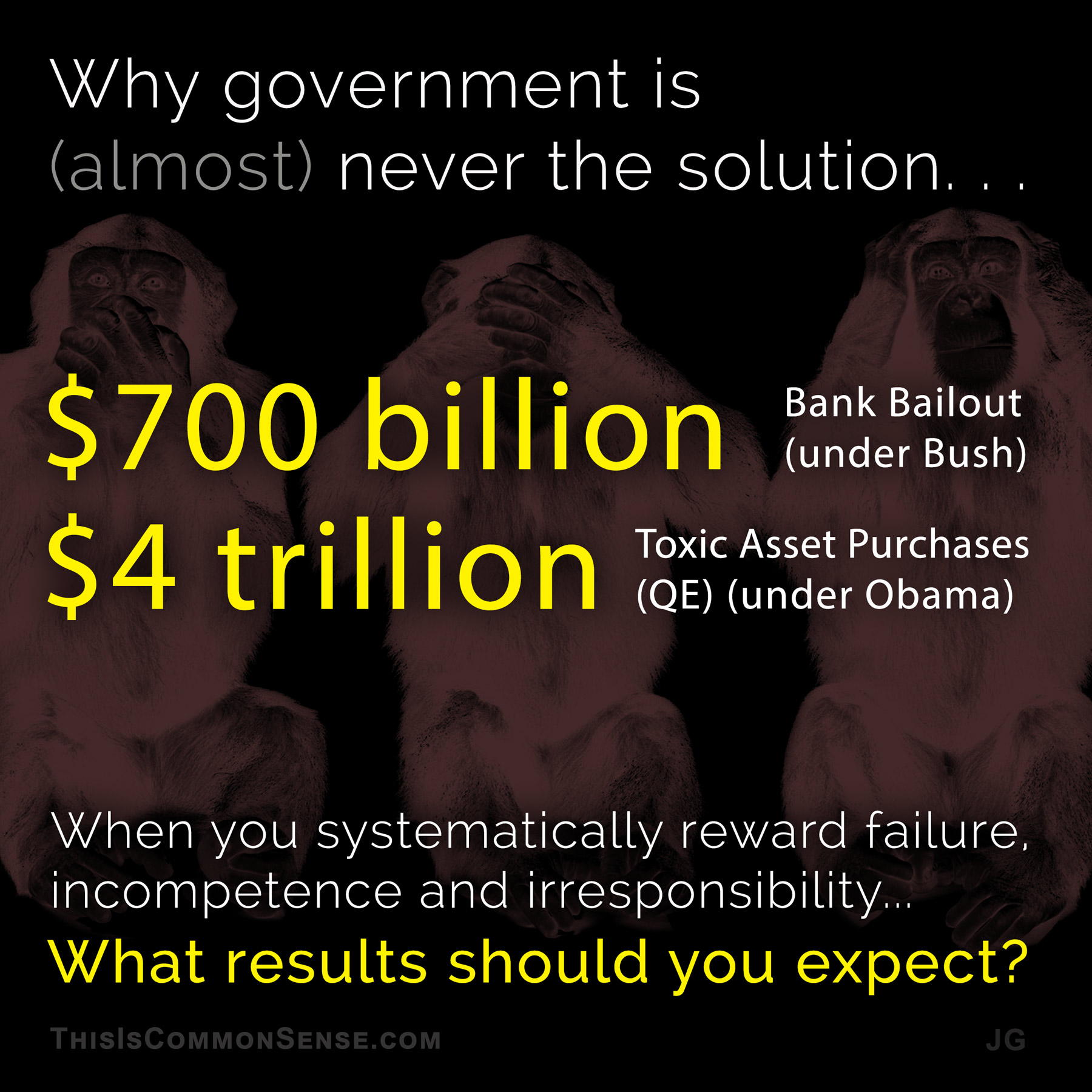

The key concept, here, is moral hazard — “The decision creates bad incentives for financial institutions and their customers” is how Ms. Brown puts it. We’ve been through all of this before. Is there really any question? The answers are in.

So, to the opening, Is it still capitalism if the capital is guaranteed? — if even Prince Harry’s fortune will be guaranteed — the answer is No.

Sorta.

It’s a special kind of capitalism. State-dominated capitalism; Neo-mercantilism; f***-ism. Use whichever term.

As we contemplate a profit-and-loss system without loss, and how the losses will be made up within the financial system, just remember that the federal government playing the role of Savior is not itself costless, and . . . its debt keeps growing. And the Ultimate Result of all this still looms.

Immoral hazard.

This is Common Sense. I’m Paul Jacob.

Illustration created with PicFinder.ai

—

See all recent commentary

(simplified and organized)