Frédéric Bastiat called it “spoliation”; California’s Democratic politicians call it social justice.

A bill went into effect last week, offering complete medical coverage to an estimated 700,000 undocumented — illegal — immigrants. The price tag? 3.1 billion dollars.

Well, not “price tag”: call it a subsidy tag.

California taxpayers will pay for it. Or perhaps U.S. taxpayers will end up with the bill, as Dagen McDowell insisted on Fox News, prophesying that the program “will turn into a national issue” that will, inevitably, “swamp the federal budget.”

Ms. McDowell also noted that the state’s targeted sugar daddies, the wealthy, “are going to other states, so much that they’ve lost a congressional seat,” all of which must lead to insolvency.

Indeed, the state is running far into the red — the color of the ink on budget columns, not voting columns. The state faces not merely annual deficits and a huge debt, there is also this looming trillion-dollar debt implied by the unfunded liabilities of the state employee pensions.

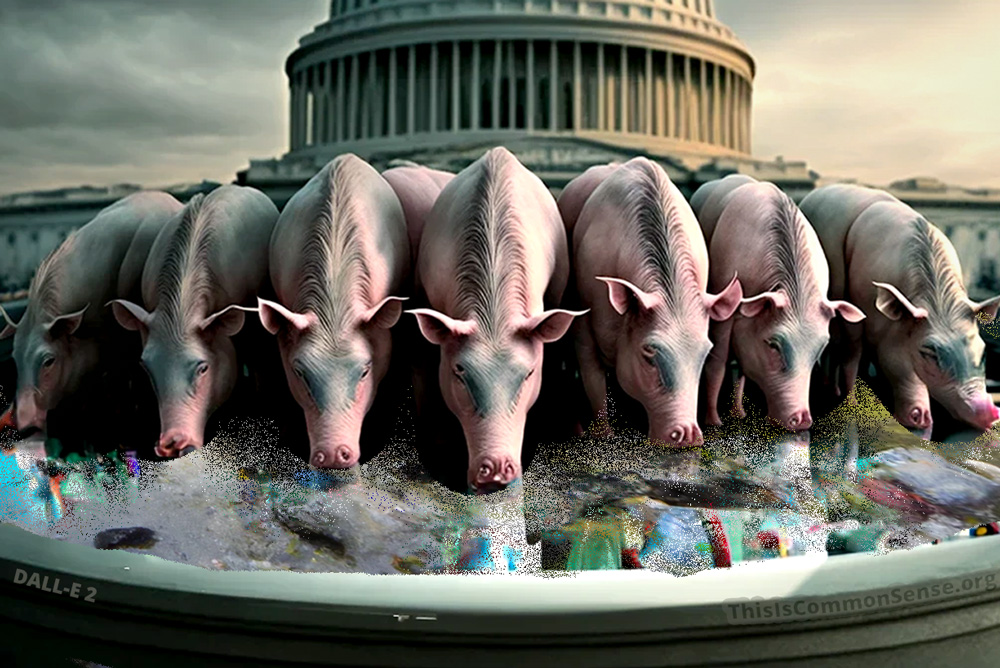

There is an old pattern here, which is why I brought up an old author in the first sentence.

First we subsidize the poor. Then we extend the subsidies up the income ladder. Now we give huge subsidies to those who enter the country illegally.

It’s as if Californians have forgotten the nature of income redistribution: you have to have income to redistribute. At some point the wealth being taken from the productive vanishes, as society becomes unproductive and descends into ruin.

There are two meanings of Bastiat’s “spoliation”:

noun

1 the action of ruining or destroying something.

2 the action of taking goods or property from somewhere by illegal or unethical means.

The two are linked.

This is Common Sense. I’m Paul Jacob.

Illustration created with Midjourney and Firefly

—

See all recent commentary

(simplified and organized)