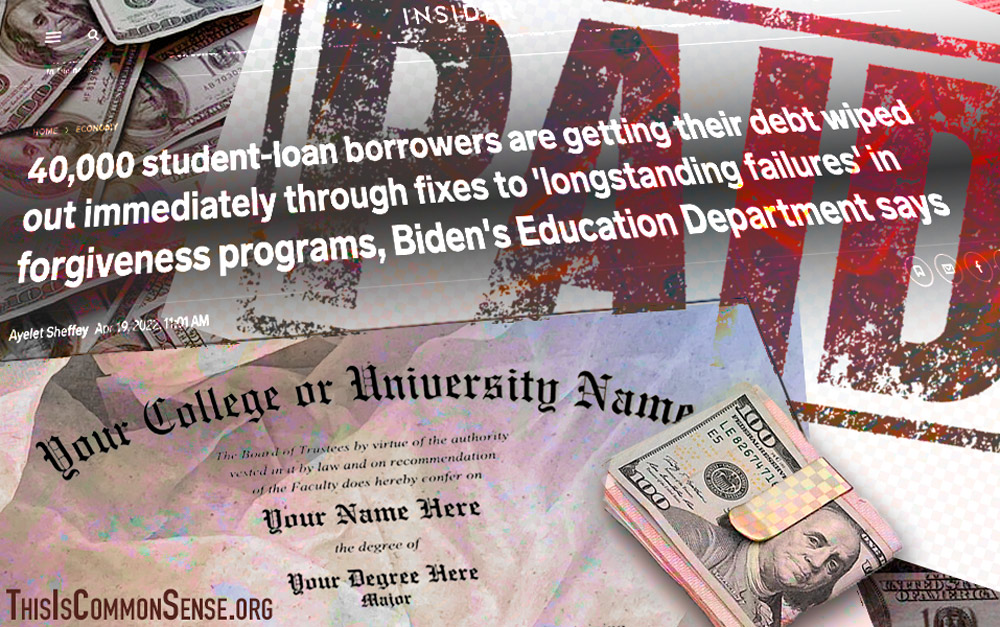

In a bid to bail out the sinking ship of his party, President Joe Biden has decided he can go ahead and bail out Americans who are having trouble paying off their student loans.

Yesterday he announced that (quoting The Epoch Times) “his administration will spend hundreds of billions of dollars to pay off $10,000 in federal student loan debt for some borrowers,” with the Education Department giving the specifics: “individuals earning less than $125,000 a year or families earning less than $250,000 will be eligible for up to $10,000 in debt cancellation.” Pell Grant recipients in the same situation will be eligible for relief of up to twice as much.

The politic nature of the move is so obvious that . . . it isn’t getting enough attention from critics.

Most of those alarmed at the move concentrate on the unfairness: rewarding those who have not met their obligations and thereby penalizing those who have. Defenders of student debt relief make the usual arguments about the need to help the under-privileged — by giving them more privilege (if anything’s a privilege it is to be able to take out a loan and then not pay it back).

You may be wondering how a president can authorize spending billions of dollars. Isn’t that Congress’s job? Well, the administration has found a semi-plausible excuse — from Congress: a 2003 higher education law that allows the Education Department to provide relief in response to a national emergency.

And what is the emergency?

Pick one. Inflation, for example.

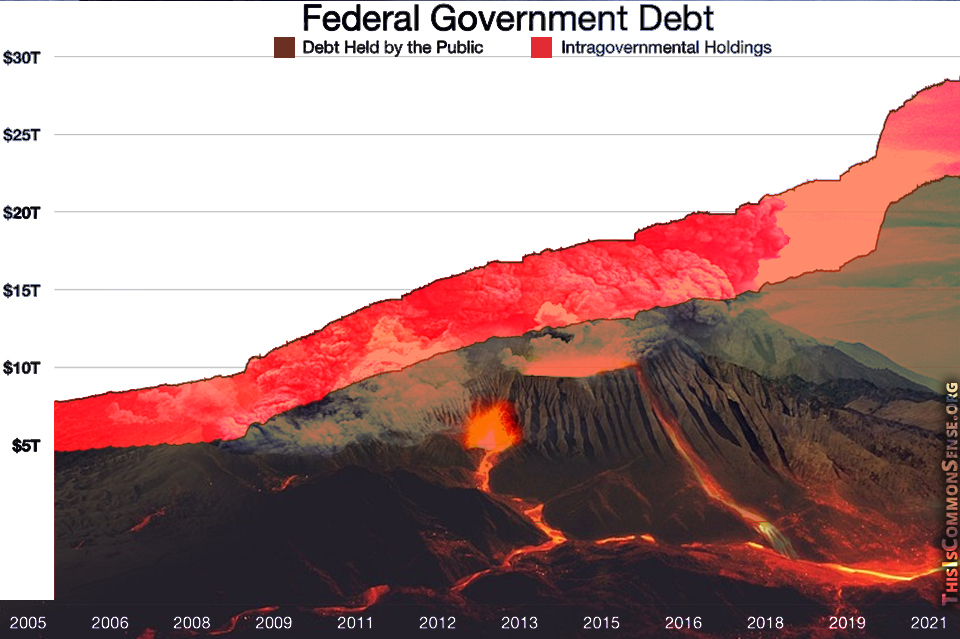

Which is spurred by overspending.

Which an extra $250 billion will merely increase.

You gotta wonder: isn’t it college graduates who cook up this stuff?

It’s ‘We the People’ who deserve not relief but a full refund.

This is Common Sense. I’m Paul Jacob.

—

See all recent commentary

(simplified and organized)