This is a little demonstration/experiment pertaining to a currently celebrated cause.

Not everybody is amused by Schiff’s stunt. But not everybody sees it as pointless, either.

This is a little demonstration/experiment pertaining to a currently celebrated cause.

Not everybody is amused by Schiff’s stunt. But not everybody sees it as pointless, either.

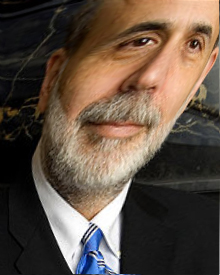

Last week, the Federal Reserve announced it was going ahead with “quantitative easing.” Chairman Ben Bernanke said that he’d be buying $40 billion dollars of mortgage-backed securities every month, no end in sight.

Now, the traditional way that the Federal Reserve influenced the money supply, economist Randall Holcombe explains, was via “open market operations by buying and selling government securities.” But this changed in 2008 with the $85 billion AIG bailout: “Since then it has engaged in continual bailouts of financial firms and purchases of non-government securities. . . .

The Fed has moved from engaging in monetary policy in a way that was neutral toward various businesses and industries in the economy to one in which monetary policy is targeted toward specific firms and industries. This current foray, specifically targeted at the housing market, is crony capitalism.

It’s actually worse. It’s crank policy, as the redoubtable Mr. Peter Schiff summarizes: “Ben Bernanke’s plan to revive the U.S. economy and create jobs is to inflate another housing bubble. That’s it. That’s what the Fed’s got. That’s what it came up with. As if the last housing bubble worked out so well for the economy that the Fed wants an encore.”

Our leaders are obviously desperate.

And out of control. George Will states that the Fed has gone far beyond “mission creep” — it’s “mission gallop on part of the Fed, which is on its way to becoming the fourth branch of government — accountable to no one and restrained by nothing, as far as I can tell, in exercising both monetary and fiscal policy.”

This is what forsaking limited government and the Constitution gets you: a sort of frantic idiocy in aid of politically connected speculators and financiers.

This is Common Sense. I’m Paul Jacob.

What have the rich got that we haven’t got? Besides money?

Well, many assaults on their money.

Less cash-encumbered mortals also get our pockets picked by those with political pull. But persons of certain envious bent are particularly eager to assail the wealthiest among us. (You know who you are, envious people and wealthy people.)

Peter Schiff took a camera to the Democratic Convention and asked attendees what they felt about the idea of curtailing or outlawing corporate profits. Interviewee upon interviewee exclaimed in grateful agreement, “Oh yes! Great idea. Love to see that!” Outlawing profit, killing enterprise, destroying economic life, turning the earth into a barren landscape, sure, let’s do it!!!

Forward!

Then there’s the Chicago Teachers Union’s strike bulletin, which was issued on September 8 but has apparently been memory-holed from the web page where the Illinois Policy Institute found it. Among the chants for union members hoping to pad their on-average $76,000 per annum salaries with a 30 percent hike were such beauties as “The war on unions is a joke. Tax the rich that made us broke. How to fix the deficit? Tax, tax, tax the rich!”

Blame the rich? While some rich people and businesses rigged and gamed the system to take huge government subsidies, thus helping “make us broke,” everyone with their hand in the cookie jar contributed. The problem is the cookie jar itself.

And I note that the teachers’ chant isn’t “Stop, stop, stop subsidizing some corporations and appeasing the ridiculous demands of teachers unions!”

This is Common Sense. I’m Paul Jacob.

Republican candidate for the U.S. Presidency Mitt Romney has received some flak for keeping some of his vast hoard of wealth in foreign accounts. Though I have a few problems with Mr. Romney, this isn’t one of them. Folks with savings and investments should diversify. Anyone with large amounts of money should consider diversifying beyond our borderlines.

And not just for “tax avoidance” reasons, either.

For one thing, as nice and generous as our politicians are, the U.S. isn’t exactly stable and business-friendly. That used to be the U.S. It may not be, any longer.

Take Peter Schiff’s new endeavor. The redoubtable Schiff, an investment expert perhaps best known for having predicted the 2008 mortgage crisis and the severity of the current recession, has started a gold bank, Euro Pacific Bank Ltd., which will back deposits with gold. The actual yellow stuff.

Its most interesting innovation will be its offer of a “gold debit card,” for use worldwide. Peter Wenzel calls this idea “awesome,” but then notes the downside:

U.S. security laws have become so intrusive, burdensome, and expensive to comply with, that it made it difficult for Schiff to offer the services in the U.S. So, Schiff opened his bank offshore, in St. Vincent and the Grenadines. It operates outside the jurisdiction of U.S. security regulations, and does not accept accounts from American citizens or residents.

America’s place in the world is changing. And not for the better.

This is Common Sense. I’m Paul Jacob.

Where do billionaires come from?

Douglas French, president of the Ludwig von Mises Institute, reminds us where the term “millionaire” came from. It was

coined in 1720 during John Law’s “Mississippi Bubble” to describe those making vast fortunes in Law’s Mississippi Company stock that rose from 150 livres to 10,000 in the matter of months. But just as quickly, the stock and the currency wildly inflated by Law’s Banque Royale, crashed and Law was forced into exile.

Today’s plethora of billionaires — which in 15 years has increased fivefold — is (argues French) at least in part the result of Ben Bernanke’s monetary manipulations. He’s the John Law of our time. “What were once Law’s millionaires are now Bernanke’s billionaires. . . . Bernanke has been on the job for six years, and the Gates, Buffetts, and Slims of the world are reaping the benefit. But for how long?”

Keeping track of today’s billionaires has become both a form of popular entertainment (Forbes’s list) as well as a topic for careful study. The political “philanthropy” of George Soros and Charles Koch inspires both enthusiasm and dread in activists, left and right; Warren Buffett has become something of a hero to the 99 percenters, what with his repeated pitches for higher taxes on the rich.

But Buffett is a sly one. He makes his money in a variety of ways — one of which Peter Schiff recently explained: “Buffett actually stated in September 2008 that he would not have invested in Goldman Sachs if not for the implicit guarantee of federal assistance. As a result, he profited at the expense of taxpayers at the very time when they were losing their savings in the markets.”

Not all billionaires are created equal.

This is Common Sense. I’m Paul Jacob.