Usually, April 15 is the deadline date, in these United States, to file taxes or apply for an extension. This year it is April 18.

Why? Many of us think of the Fifteenth of April as Tax Day. It seems strange and arbitrary when it is jiggered with. And kind of annoying.

But a postponement of taxes could be a postponement we might all appreciate as a tiny (ever so slight) reprieve.

So, again, why this year’s three-day extra leeway?

First off, it is regularly postponed when the day falls on a Saturday or Sunday.

Could it be that the “Nothing Gets Done on Friday” Rule has been acknowledged by the fine folks at the Internal Revenue Service?

No.

People in Maine and Massachusetts celebrate Patriots Day on April 18, so their tax day is set another day later, April 19.

Which begs the question. Why the 18th in the first place?

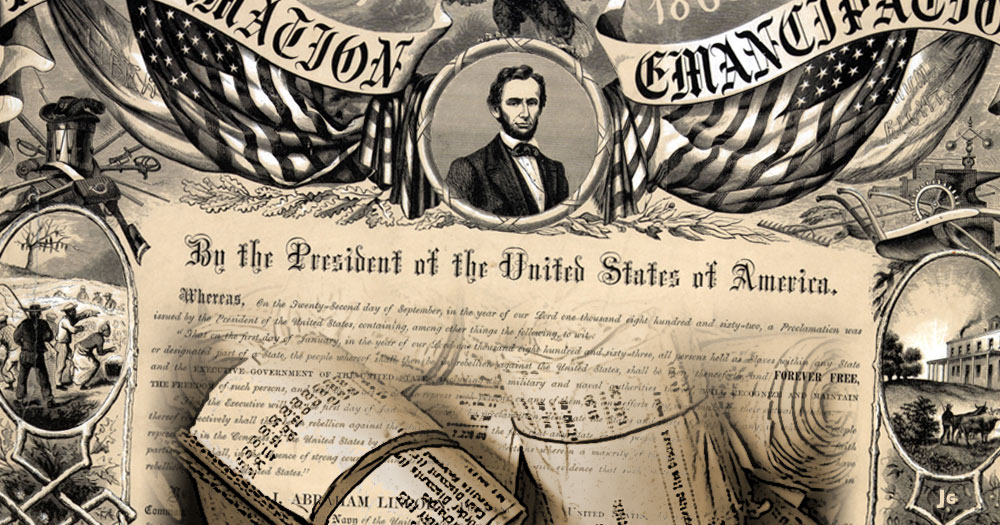

Well, because of Emancipation Day, usually celebrated in Washington, DC, on April 16.

Because the 16th settles on a Saturday this year, and because the day is a traditional day off for federal workers, the holiday shifts a day in advance, to this Friday, the 15th. So, Emancipation Day — commemorating the signing of the Emancipation Act by President Abraham Lincoln — trumps Tax Filing Day.

Apt, since it might seem cruel to Americans to have Tax Day, marking the subservience of a whole population to its government, fall on something called Emancipation Day.

After all, consider: holding them on the same day? Hmmm. Might get people thinking.

Bigwigs in DC don’t want that.

This is Common Sense. I’m Paul Jacob.

Common Sense Needs Your Help!

Also, please consider showing your appreciation by dropping something in our tip jar (this link will take you to the Citizens in Charge donation page… and your contribution will go to the support of the Common Sense website). Maintaining this site takes time and money.

Your help in spreading the message of common sense and liberty is very much appreciated!