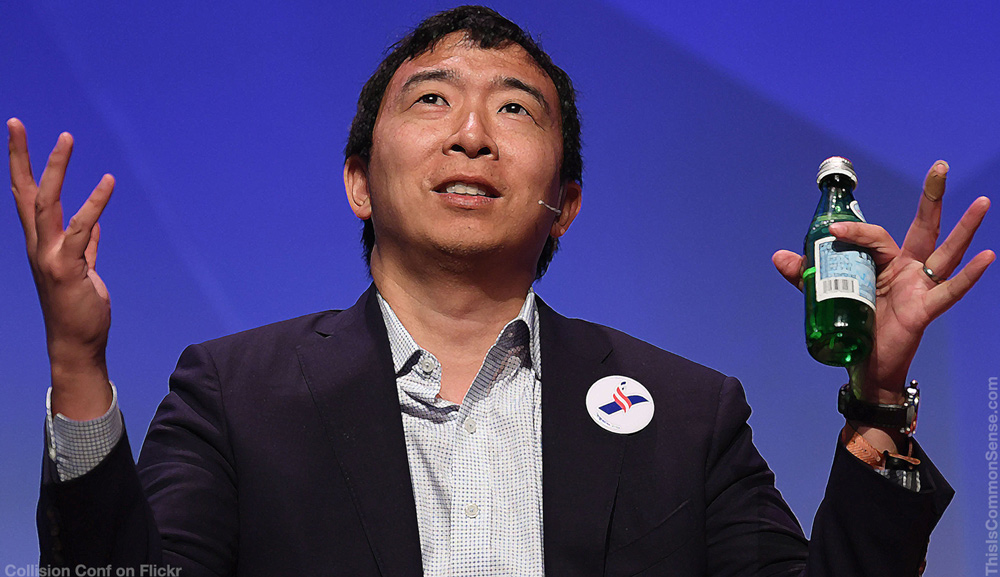

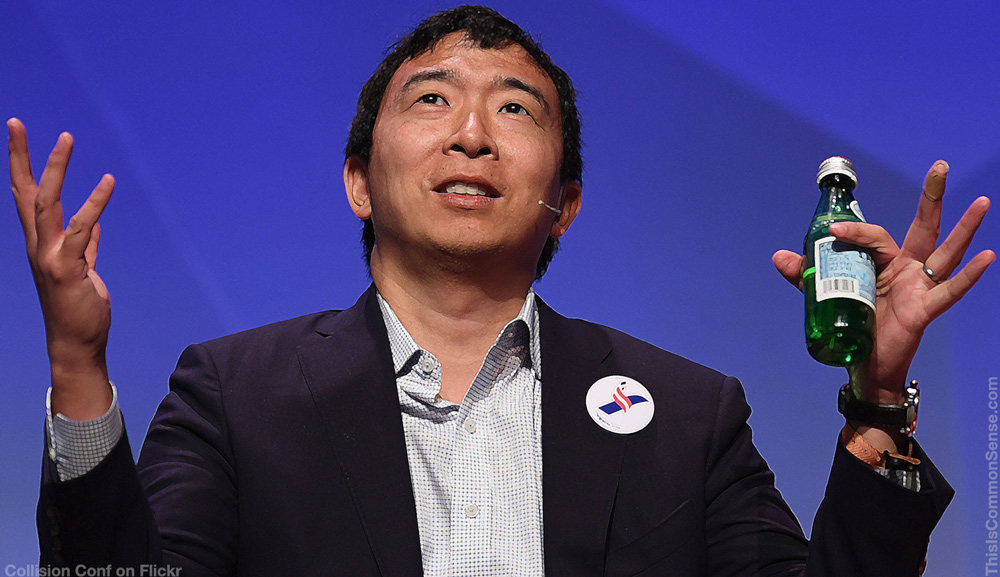

Democratic Presidential candidate Andrew Yang has at least one good policy preference: he opposes tough land use and zoning regimes.

And he is not alone.

“Yang’s criticism of zoning is pretty close to what other Democratic primary candidates have said on the subject,” writes Chistian Britschgi at Reason. “Sens. Cory Booker (D–N.J.), Elizabeth Warren (D–Mass.), and Amy Klobuchar (D–Minn.), and former Housing and Urban Development Secretary Julian Castro have all targeted restrictive local land use regulations as a cause of high housing costs.”

Mr. Yang’s website clarifies the problem: “Those who already own homes have made it significantly harder for those who don’t to recognize that dream. Through NIMBY (not in my backyard) and zoning laws, the ability of new housing to be built in certain areas has been impeded to the point where the vast majority of Americans can’t afford to live in the largest cities.”

But while Yang recognizes that zoning is best dealt with on a local and state level, his more famous competitors offer fixes, Britschgi notes, that “require the federal government to either spend more money or attach more regulations to the money it already spends.”

Here’s the bottom line: Several Democrats competing for the highest office in the land recognize government interference as the leading cause of the housing crunch and its high prices.

Yet, instead of fighting bad policies at the state and local source, they advocate more federal spending. And they most decidedly do not apply their housing regulation realism to other problems we face.

This is Common Sense. I’m Paul Jacob.

—

See all recent commentary

(simplified and organized)

1 reply on “Recognizing a Problem”

Are you seriously proposing “easing the restrictions” imposed by building codes? If you do not tread very carefully here, we could end up with a safety bubble costing lives rather than just money as in the earlier housing bubble.